The dream of homeownership in Canada seems increasingly out of reach for many, especially in 2024. With housing markets fluctuating and interest rates climbing, Canadians find themselves asking: Why has it become so challenging to buy a house?

Soaring Income Requirements

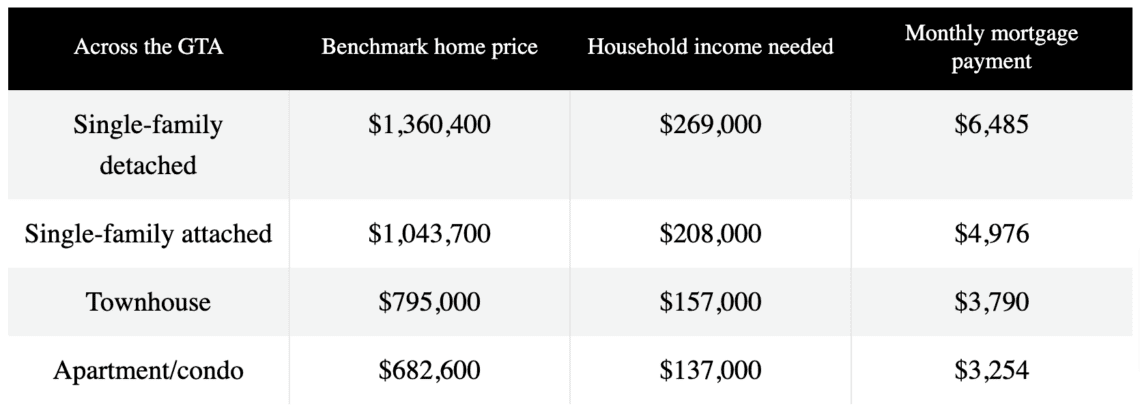

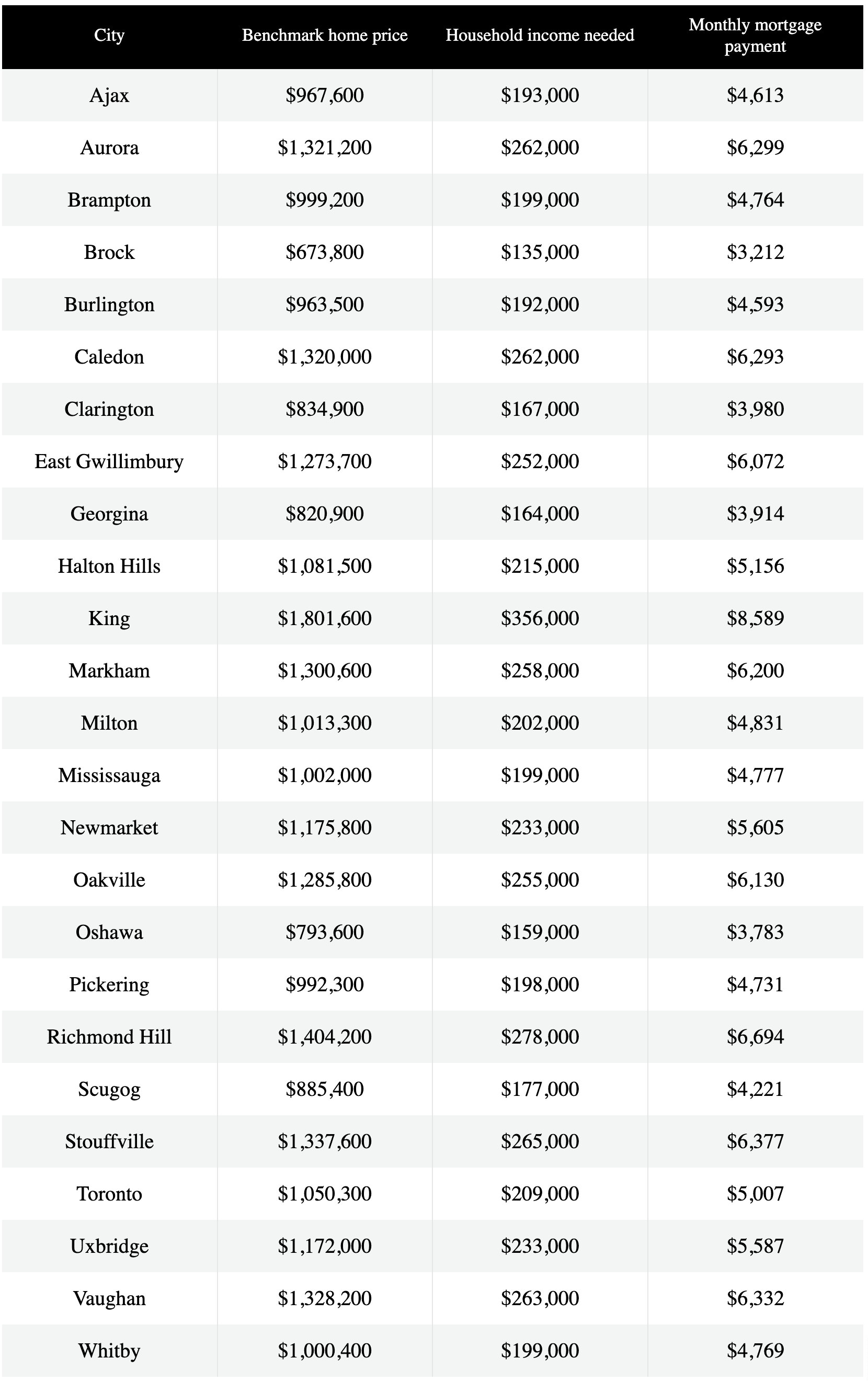

The journey to homeownership in Toronto and the GTA presents significant financial hurdles, as detailed in recent 2024 analyses. To afford a home in this region, a household income far exceeds the national average is required. For example, purchasing a single-family detached home in the GTA now necessitates a household income of approximately $269,000, reflecting the economic gap between average earnings and housing affordability. Specifically in Toronto, a potential homebuyer needs around $209,000 in annual income to purchase a median-priced home at $1,050,300. These figures underscore a harsh reality: despite a slight easing of mortgage rates, the income needed to buy a home remains dauntingly high, exacerbated by lingering high property values and stringent mortgage approval conditions, including the mortgage stress test which now uses higher benchmark rates (MoneySense).

A Market in Transition

While it’s true that housing prices in certain areas have seen a decrease, the overall picture remains daunting. Across Canada, home prices are still significantly higher than they were pre-pandemic. Markets may be cooling slightly, but they haven’t cooled enough to open the door for average Canadians. Plus, despite a shift towards what may be considered a more balanced market in some cities, high mortgage rates create a formidable barrier, making it difficult for many to enter the housing market at this time.

Beyond the Middle-Class Reach

The narrative around homeownership in Canada is changing. Once a feasible milestone for the middle class, buying a home is now a goal seemingly reserved for the wealthier segments of society. The stringent mortgage stress test, combined with elevated property prices, has created an environment where only the financially well-off can consider purchasing in major urban centers. This trend is not just isolating potential buyers in cities but also pushing them towards smaller towns, impacting housing markets across the country.

Political Influences and Market Speculation

Changes in government policies and the political landscape also play a role. For example, in British Columbia, the anticipation of new measures to curb housing prices under a coalition government has influenced market dynamics, with many choosing to sell their properties before potential price drops. Such policy changes aim to make housing more affordable, but their effectiveness and broader impacts remain to be seen.

What Does This Mean for Prospective Buyers?

For Canadians contemplating entering the housing market, the current environment demands careful consideration. While it may seem counterintuitive, in some cases, buying now could provide advantages, such as building equity sooner or leveraging market conditions that favor buyers in specific regions. However, this decision is highly personal and contingent on numerous factors, including one’s financial stability, credit status, and long-term housing plans.

As Canada’s housing landscape continues to evolve, staying informed and seeking professional advice can be crucial steps in navigating this challenging market. Whether looking to buy now or waiting for potentially more favorable conditions, understanding the forces at play can help prospective homeowners make informed decisions.

The housing market in Canada is complex and multifaceted, influenced by economic, political, and societal factors. As we move forward, it will be essential to monitor these trends and adapt strategies accordingly, whether one is looking to buy, sell, or simply understand the dynamics of Canadian real estate.

For anyone grappling with these decisions, the message is clear: You’re not alone in finding it hard to secure a piece of the Canadian dream. With persistence, informed decision-making, and perhaps a bit of luck, navigating the path to homeownership, while challenging, is not entirely out of reach.

Free Buyer Consultation

Equip yourself with the knowledge to navigate the complexities of the 2024 real estate landscape confidently.