The Toronto real estate market has long been synonymous with sky-high prices and tough affordability. But in October 2024, there’s a glimmer of relief for hopeful homebuyers. With mortgage rates dipping and average home prices softening, the income needed to own a Toronto home is now slightly more within reach.

So, how much do you actually need to earn? Let’s dive into the latest insights and what they mean for you.

The Numbers You Need to Know

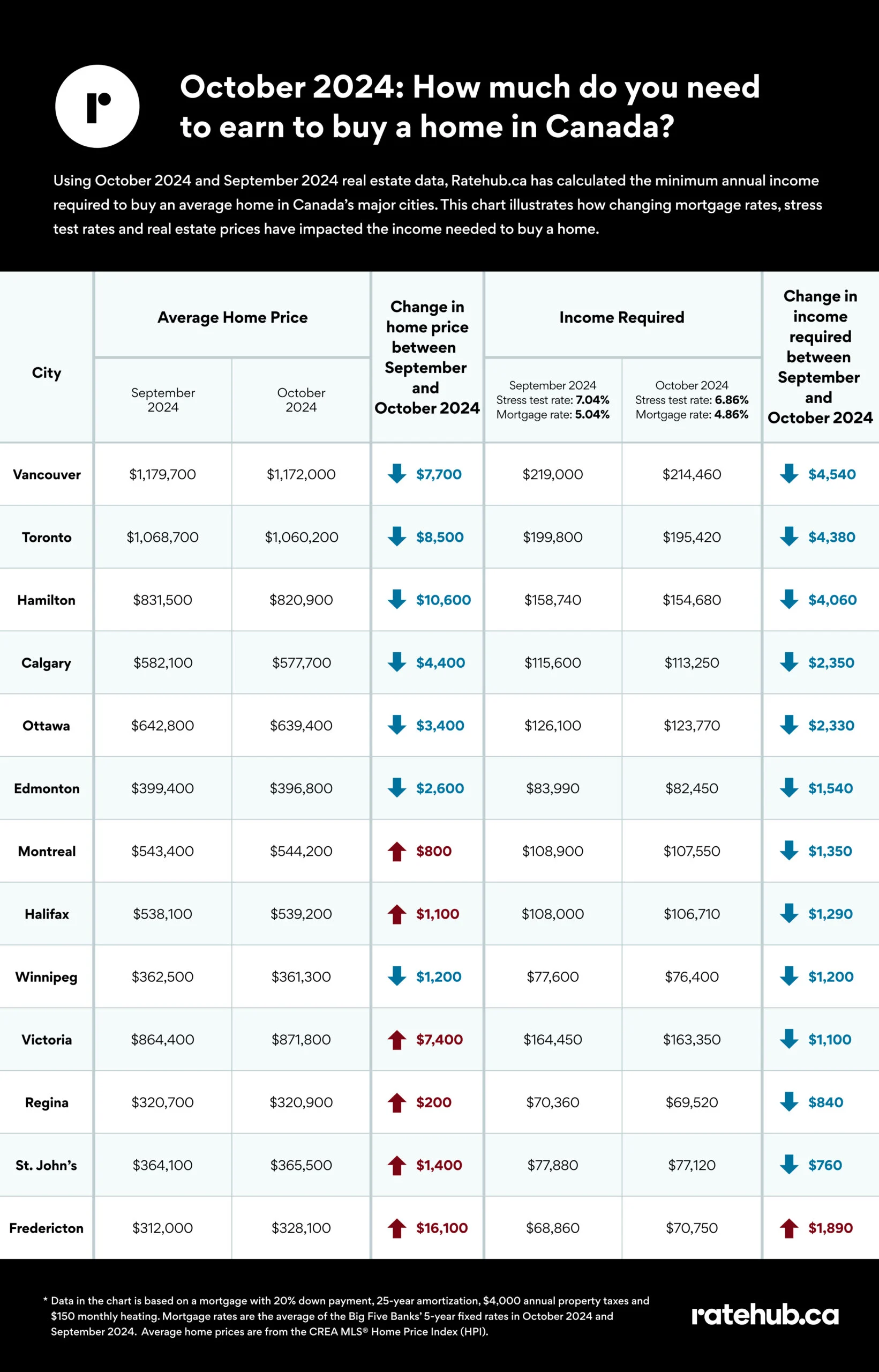

According to Ratehub.ca’s latest report, the average Toronto home price dropped by $8,500 last month, settling at $1,060,200. This translates into a reduced income requirement—homebuyers now need to earn $195,420 annually, $4,380 less than in September.

What’s driving this? The Bank of Canada’s interest rate cuts have eased borrowing costs, making mortgage payments more manageable despite Toronto’s reputation as Canada’s second-priciest market.

Toronto Isn’t Alone in Price Drops

Toronto isn’t the only city experiencing a shift. Here’s how some other major markets compare:

- Vancouver: The average home price fell by $7,700, requiring $214,460 in annual income—still Canada’s highest.

- Hamilton: Prices dropped by $10,600, making it one of the most affordable nearby cities for GTA buyers.

- Fredericton: The outlier, with rising prices and an income requirement increasing by $1,890.

What Does This Mean for You?

For buyers, this is the moment to plan strategically. Lower rates and price adjustments create an opportunity to enter the market with slightly reduced financial strain.

For sellers, understanding these trends can help you set competitive pricing and attract motivated buyers. And for investors? Now might be the time to lock in deals before the market heats up again, as experts predict interest rate cuts will drive demand—and prices—higher in 2025.

The Bigger Picture

While affordability has improved, Toronto’s real estate remains a high-stakes market. Even with these changes, buying a home requires careful planning. The stress test rate is still at 6.86%, and the average fixed mortgage rate hovers at 4.86%—lower than last month but still a major factor in monthly costs.

What’s Next?

If you’re thinking of buying, selling, or investing, now’s the time to act. Economists expect further interest rate cuts this December, which could trigger a surge in buyer activity and rising prices in 2025.

Key Takeaways

- Toronto homebuyers now need $195,420 annually to afford the average home—$4,380 less than last month.

- Mortgage rates and stress test rates are trending down, improving affordability nationwide.

- Interest rate cuts in 2025 could heat up the market again, so timing is critical.

Looking for expert advice? Whether you’re ready to buy, sell, or invest, our team is here to help. Contact us today for tailored strategies to navigate Toronto’s evolving real estate landscape. Don’t forget to follow our blog for more insights like this!

Contact Us

Equip yourself with the knowledge to navigate the complexities of the real estate landscape confidently.