Hey there! Dreaming about buying your own house in Canada and wondering how long you’ll need to save up? Let’s break it down in a simple way that’s easy to understand.

Understanding the Minimum Down Payment

Imagine you’ve set your heart on getting a lovely place with enough room for a big kitchen, a cozy office, a play area for kids, or even a backyard for your furry friends. Sounds great, right? But we all know that buying a home needs some serious saving first.

Saving Fast in Affordable Cities

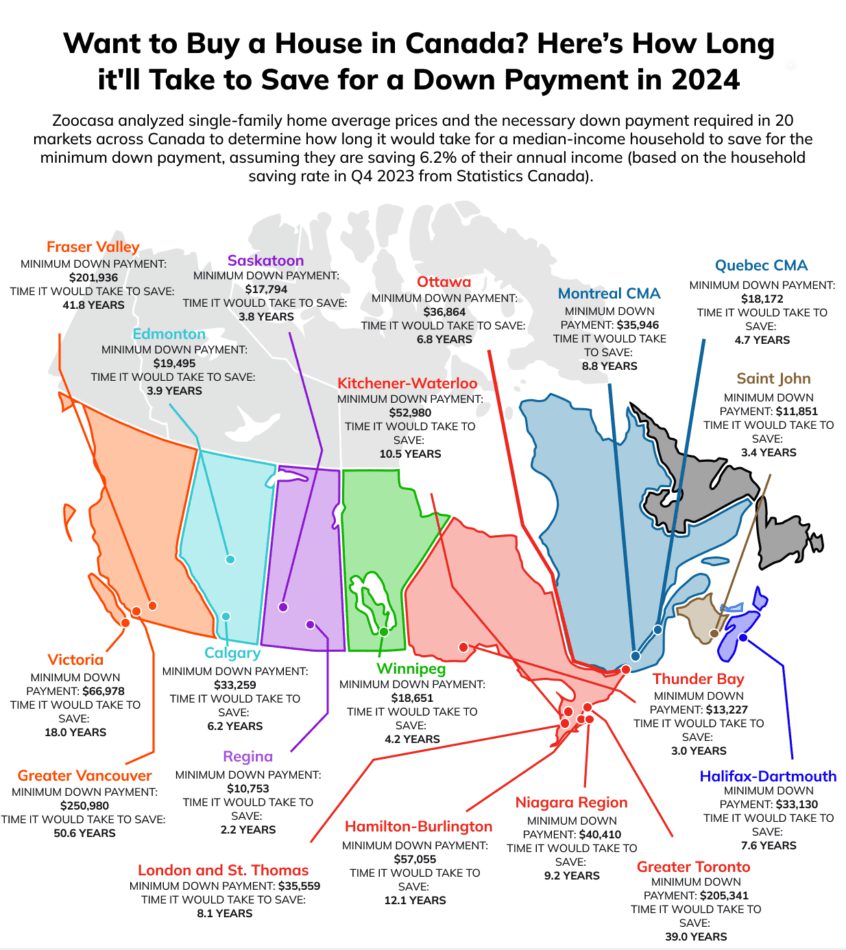

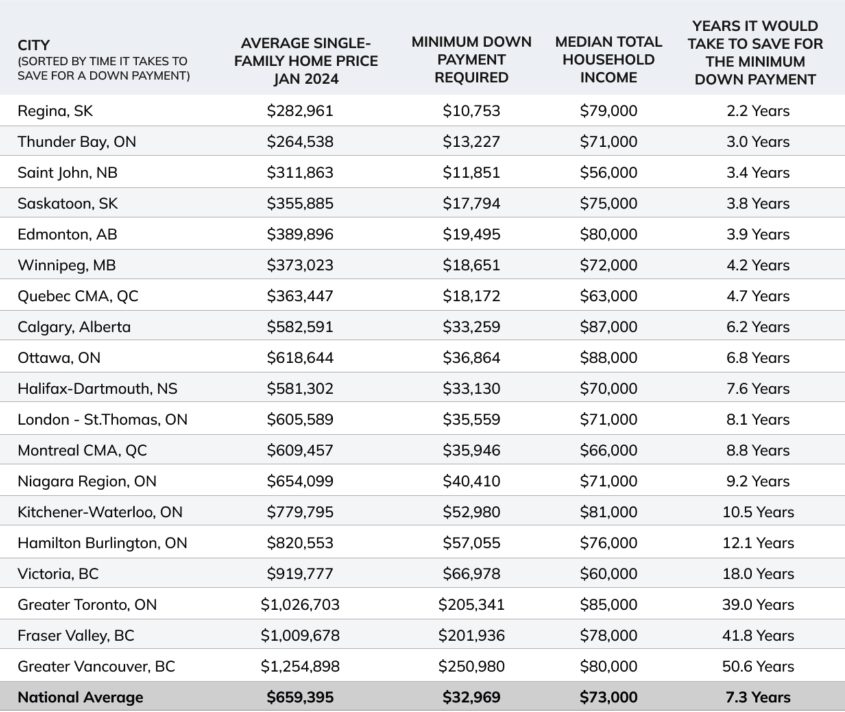

Now, there’s this study from Zoocasa that looked into how long it takes to save for a house in 20 big Canadian cities. They checked out how much money you’d need for a down payment and figured out how long you’d need to save, assuming you put away 6.2% of what you earn every year. That percentage comes from what most Canadian families managed to save in late 2023.

Regina and Thunder Bay – Your Best Bets

In places like Regina and Thunder Bay, your dream of owning a home is totally achievable without waiting forever. In Regina, if your family makes an average income, you could have enough for a down payment in just over two years. The best part? Homes there are way cheaper than the average across Canada. Plus, folks in Regina usually earn a bit more than in other places.

Thunder Bay is another awesome spot for affordable homes. You could be ready to buy in three years by saving just a slice of your salary.

Achievable Goals in Other Friendly Cities

There are cities like Saint John, Edmonton, and Saskatoon where you can also save up fast, in under five years. Even though some places might have lower average incomes, the cheaper house prices help a lot. Like in Edmonton, you’ve got higher salaries and lower home prices, making it a sweet spot for buying a home.

Longer Terms in Pricier Areas

Now, not every city is this quick. In some, you might need to save for five to ten years, but that’s still doable. And then there are the big guys, like Toronto or places in British Columbia, where saving for a house can feel like it takes a lifetime.

Smart Strategies for Your Minimum Down Payment

But don’t let that get you down! Even if you’re eyeing a home in a pricier area, there are smart ways to get there faster. Think about living a bit away from the city center, especially if you can work from home. Or maybe consider buying a place with a friend or a family member.

Buying a house is a big dream, and it’s totally possible with a bit of planning. If you’re curious about what you can afford or just want to chat about your options, give us a shout. We’re here to help you find the perfect home in your budget!