Embarking on the journey of acquiring real estate can be an exhilarating adventure, fraught with complexities and nuanced differences across borders. For many, the dream of homeownership shines bright, yet the path to its attainment varies significantly between neighbors: Canada and the United States. As potential homebuyers in the Greater Toronto Area (GTA) set their sights on their piece of the real estate pie, understanding these variances becomes crucial.

Down Payment Requirements

In Canada, the threshold to enter the housing market is marked by stringent down payment requirements, particularly in high-demand locales like the GTA. A minimum of 5% is necessary for homes under $500,000, scaling up to 20% for properties exceeding the $1 million mark. This contrasts starkly with the U.S. landscape, where aspiring homeowners can often embark on their journey with as little as 3% down, significantly lowering the barrier to entry.

Mortgage Options and Amortization Periods

The blueprint of mortgage options further delineates the home buying experience in these two nations. Canadian homebuyers typically navigate shorter mortgage amortization periods, up to 25 years, alongside periodic renegotiations. Conversely, the U.S. system offers more extended amortization periods, exceeding 30 years, with fixed terms that provide predictability and stability over the mortgage lifecycle.

First-Time Home Buyer Incentives

Canada’s First-Time Home Buyer Incentive shines as a beacon for many, particularly in pricey markets like Toronto, offering 5-10% of the home’s purchase price to fortify the down payment. While the U.S. presents a mosaic of state-specific incentives, a direct national parallel offering equivalent support is absent.

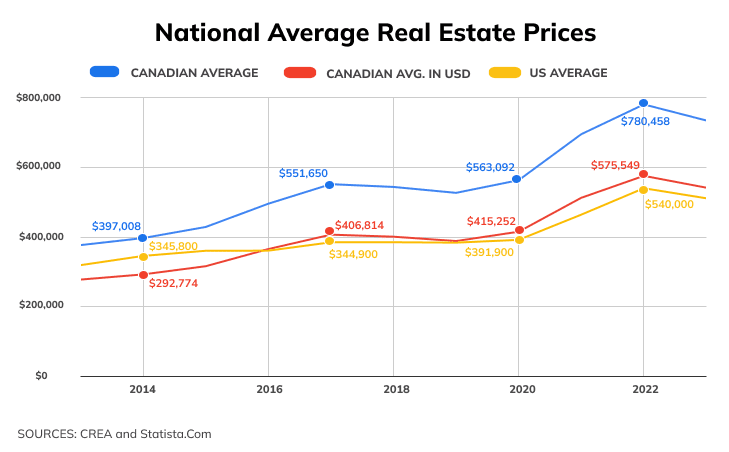

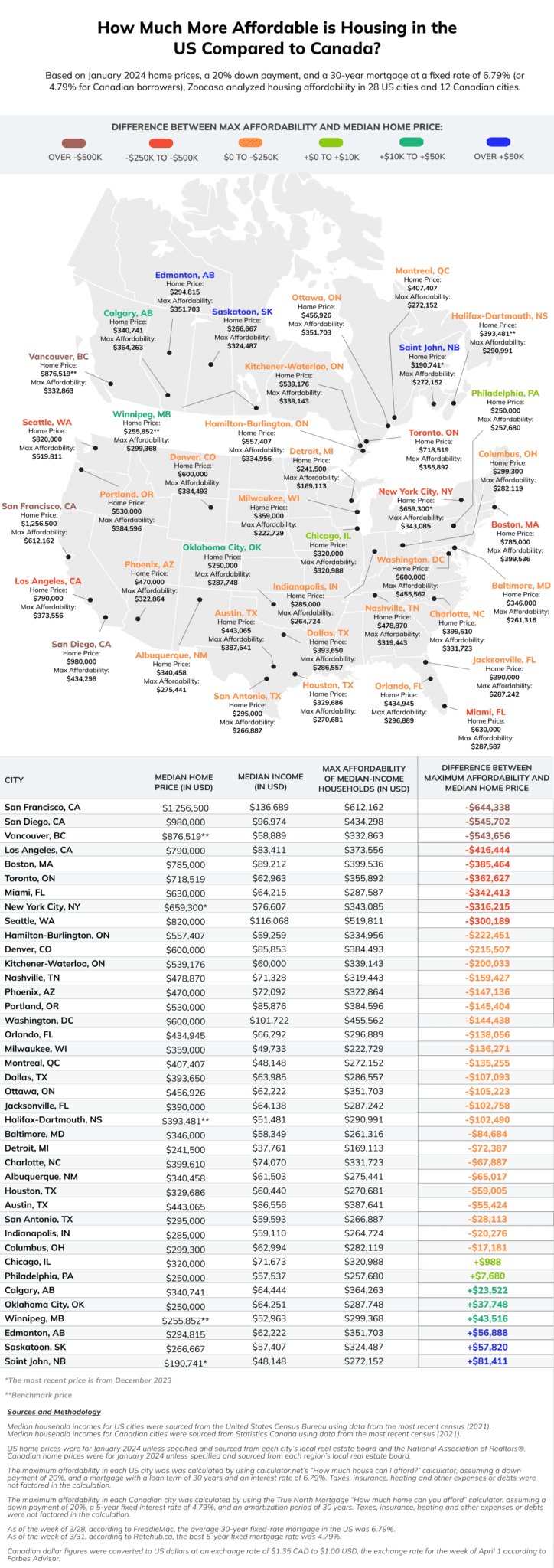

Deciphering Market Dynamics: Affordability and Availability

Venturing into the market reveals a stark reality: Canadian urban centers, especially the GTA, boast some of North America’s highest real estate prices. This economic landscape, juxtaposed with relatively lower median incomes compared to the U.S., erects formidable barriers to entry for many Canadians. The American real estate ethos, characterized by more moderate pricing and a plethora of options, often provides a less arduous path to property ownership.

Closing Times

The race to closing varies markedly between these two nations. In Canada, a swift sprint of two to four weeks can see a deal sealed. In contrast, American real estate transactions are more akin to a marathon, with durations stretching up to 60 days, influenced by local regulations and market conditions.

The Verdict: A Comparative Gaze

While the allure of homeownership beckons across North America, the terrain differs significantly between Canada and the U.S. Canadian potential buyers, particularly in the GTA, face steeper initial financial hurdles, more constrained mortgage options, and soaring market valuations. Meanwhile, their American counterparts navigate a landscape marked by broader accessibility, more favorable financing terms, and a wider array of opportunities for entry-level investment.

For residents of the Greater Toronto Area, understanding these distinctions is not merely academic—it’s a critical component of strategizing for one of life’s most significant investments. Whether you’re a seasoned investor or a first-time buyer, arming yourself with knowledge is the first step on the path to real estate success.

Would you like to dive deeper into specific aspects or need guidance on navigating the GTA’s unique market? Let’s explore the road map to your dream home together.

Free Buyer Consultation

Equip yourself with the knowledge to navigate the complexities of the 2024 real estate landscape confidently.