For many aspiring homeowners in the Greater Toronto Area (GTA), understanding how much mortgage they can afford is pivotal. This comprehension is crucial as mortgage payments typically represent the most significant monthly financial obligation, surpassing everyday living expenses and property taxes. Recognizing the nuances of mortgage calculations is fundamental for your financial well-being and strategic planning in Toronto’s dynamic real estate market.

Understanding Mortgage Affordability in the GTA:

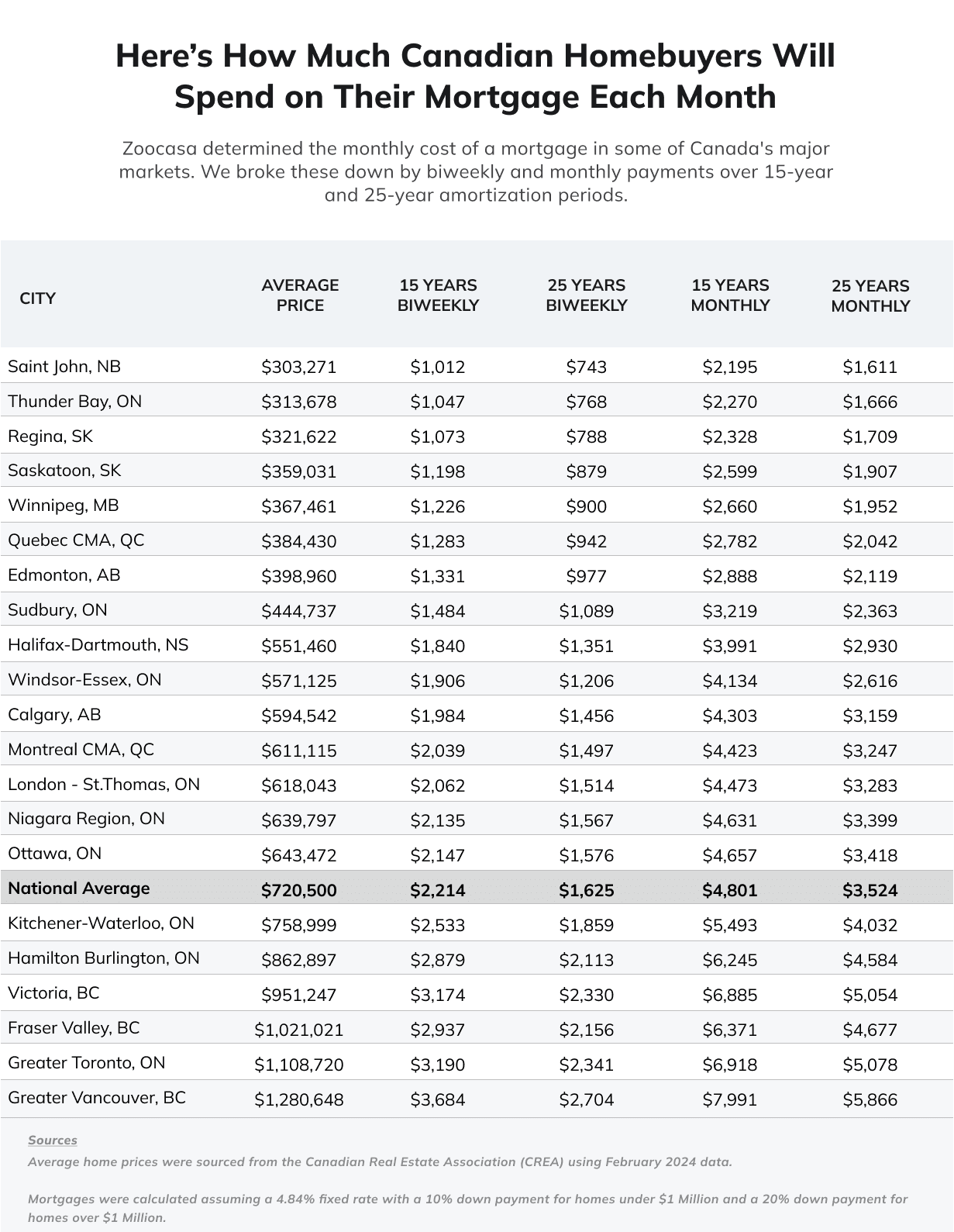

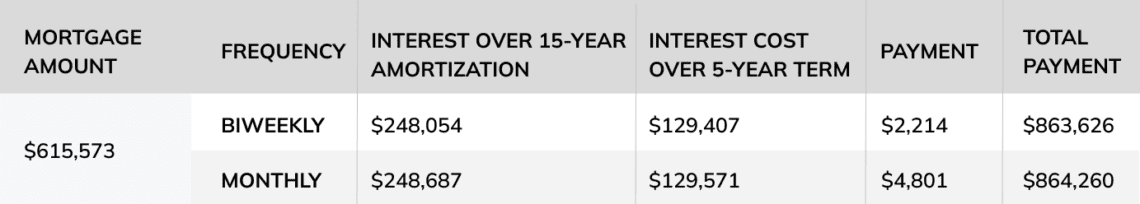

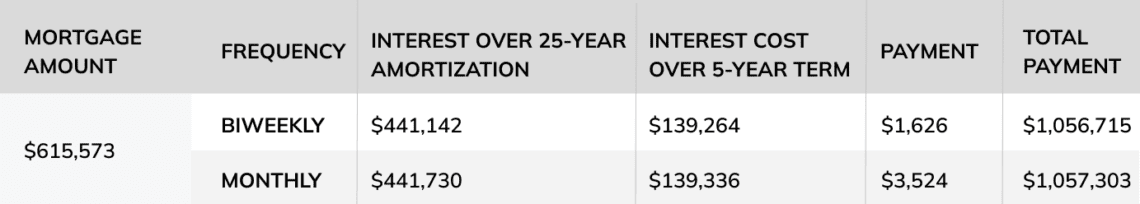

A comprehensive study by Zoocasa offers a deep dive into mortgage payments across Canada, contrasting them with GTA-specific scenarios. This analysis factors in various mortgage configurations, highlighting the distinct financial landscapes of Toronto compared to national averages.

Crucial insights indicate that despite the high property values and corresponding mortgages in the GTA, informed financial strategies can unveil avenues for savings and prudent investments. Such awareness is indispensable for gauging how much mortgage you can afford in this competitive market.

Key Strategies for Mortgage Affordability in the GTA:

- Term Length Comparison: Assessing the financial implications of different mortgage terms, such as 15-year versus 25-year loans, is vital. This evaluation can significantly influence the total interest paid, affecting your long-term financial health.

- Down Payment Considerations: In the GTA, particularly for properties nearing the $1 million mark, down payment size is a critical determinant of mortgage affordability. Larger down payments can substantially decrease overall interest costs and monthly payment amounts.

- Market Timing: Given the GTA’s fluctuating real estate conditions, the timing of your home purchase or refinancing is crucial for cost-efficiency. Keeping abreast of market trends and economic forecasts can guide you in making timely and advantageous property decisions.

Navigating Toronto’s Diverse Real Estate Market:

The diversity of Toronto’s housing market presents varied mortgage affordability scenarios. While central Toronto areas feature higher mortgage rates reflective of urban lifestyle premiums, the surrounding regions offer more economical alternatives without sacrificing accessibility or convenience.

Factors GTA Homebuyers Should Evaluate:

- Property Type Choice: Opting between different housing styles, such as condos or detached homes, significantly impacts your mortgage payments and financial outlook.

- Regional Pricing Differences: Exploring areas beyond downtown Toronto, like Mississauga or Brampton, might reveal more affordable housing opportunities, crucial for determining how much mortgage you can afford.

- Future-Proof Investments: Properties in emerging neighborhoods or those expected to develop rapidly could provide valuable investment opportunities, potentially enhancing your property’s future value.

In summary, GTA’s real estate market demands meticulous financial planning and informed decision-making. By carefully considering these factors, you can better understand how much mortgage you can afford, aligning your property choices with your financial goals and lifestyle preferences in this vibrant region.

Free Buyer Consultation

Equip yourself with the knowledge to navigate the complexities of the 2024 real estate landscape confidently.