As the Bank of Canada continues its path of lowering interest rates, many Canadians are pinning their hopes on a revived economy and a boost in the housing market. But before you get too excited, especially if you’re a homebuyer, seller, or investor in the Greater Toronto Area (GTA), there’s more to this story that you need to know.

Why It’s Important to You

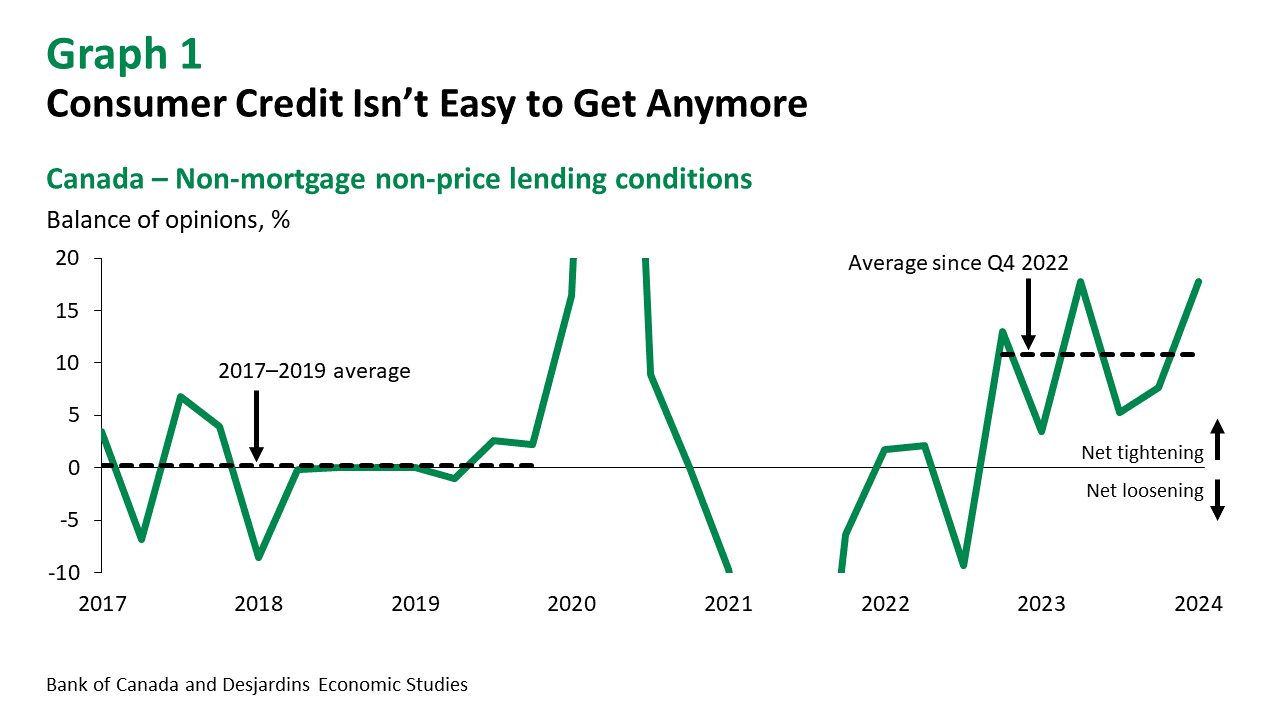

The expectation might be that lower rates will make borrowing cheaper and easier, fueling consumer spending and, importantly for the real estate market, home purchases. But the reality is more complex. The tightening of household lending conditions, as reported by the Bank of Canada, has been ongoing for over a year. In simple terms, this means that despite lower interest rates, getting credit—whether for a mortgage or other loans—is becoming more challenging.

For anyone looking to buy or sell a home in the GTA, this is crucial information. The housing market’s health is closely tied to consumer borrowing power. If credit remains tight, the expected boom in real estate activity may not materialize, leading to potential price stagnation or even declines in some areas.

The Numbers Behind the Scene

Recent data shows that financial institutions have tightened their non-mortgage lending conditions in four of the last five quarters (Graph 1). This is a significant streak, the likes of which we haven’t seen outside of extraordinary circumstances like the COVID-19 pandemic.

Furthermore, delinquency rates are rising. Equifax reports a 12.2% year-over-year increase in the number of consumers who were delinquent on at least one credit payment in the first quarter. This trend suggests that Canadians are struggling to manage their debts, which is reflected in declining credit scores and fewer people paying off their credit card balances in full each month.

Why This Matters: The Risk to the Housing Market

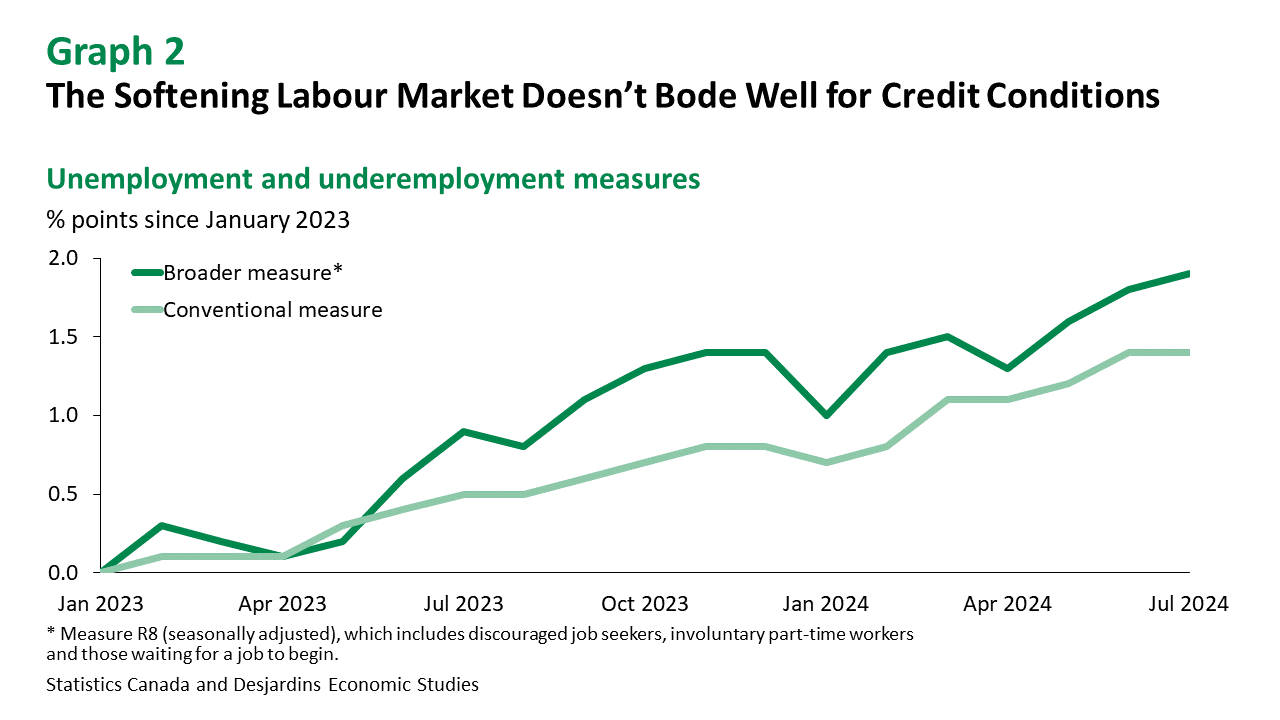

For potential homebuyers in the GTA, this tightening of credit means that even with lower interest rates, securing a mortgage could be more difficult. Lenders are becoming increasingly conservative, likely due to rising unemployment and falling disposable incomes. Employment in Canada has declined for two consecutive months, and the unemployment rate has risen by 1.6 percentage points from its low.

These economic indicators (Graph 2) are critical for anyone involved in the housing market. If you’re selling, you may find fewer qualified buyers, and if you’re buying, the process may involve more stringent checks and possibly higher down payments or interest rates than you anticipated.

The Bigger Picture: How Long Until Things Improve?

Even if the Bank of Canada continues to lower rates, the effects on the economy won’t be immediate. Research suggests that it takes about six quarters—nearly a year and a half—before the impacts of a credit supply shock begin to diminish (Graph 3). This delay means that while rate cuts are happening now, the real benefits might not be felt until well into 2025 or later.

For investors, this period could be one of caution. If the credit crunch persists, it could lead to a more pronounced slowdown in the real estate market, which could affect property values and rental incomes.

What You Should Do Now

For homebuyers: Prepare for a potentially more challenging mortgage approval process. Ensure your credit is in good standing and consider locking in a rate sooner rather than later, as conditions might not improve quickly.

For sellers: Be aware that the pool of qualified buyers may shrink. Pricing your property competitively and being flexible on terms could make the difference in closing a deal.

For investors: Monitor the broader economic indicators closely. The long-term outlook may still be positive, but in the short term, the market could see fluctuations that impact both property values and rental demand.

In conclusion, while lower interest rates might sound like great news, the underlying economic conditions suggest that caution is warranted. The road to recovery may be longer and bumpier than anticipated, especially in the housing market. Stay informed, plan ahead, and adjust your strategies accordingly to navigate this uncertain landscape.

Contact Us

Equip yourself with the knowledge to navigate the complexities of the real estate landscape confidently.