Today, we want to share some important insights about the potential changes in interest rates and what they could mean for you.

Bank of Canada’s Strategy: Anticipated Rate Cuts Explained

Recently, there’s been a buzz around the Bank of Canada (BoC) potentially leading the way ahead of the U.S. Federal Reserve in terms of lowering interest rates. This move is largely due to Canada’s weaker GDP growth compared to our neighbors to the south and a more significant cooling in our inflation rates. For those of us living in the beautiful GTA, these changes could have a direct impact on our mortgages and overall financial well-being.

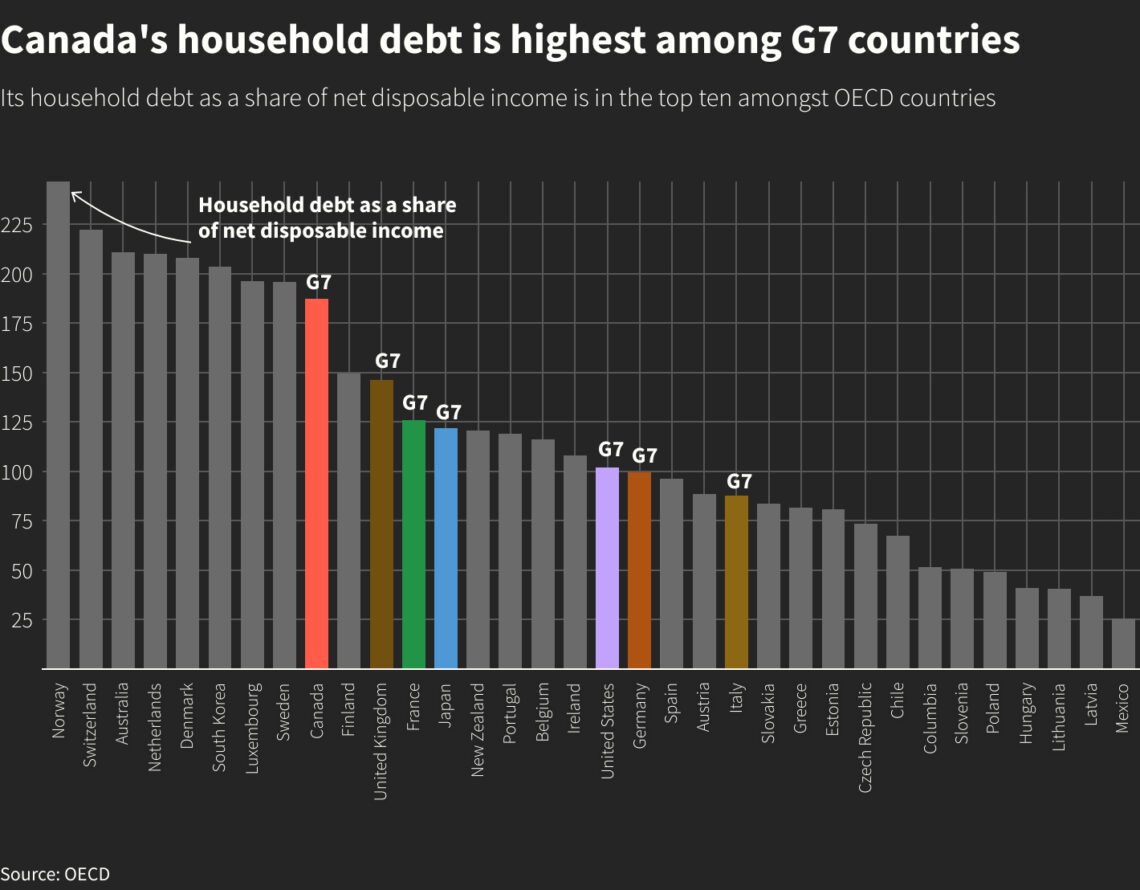

The crux of the matter is that our Canadian economy is quite sensitive to interest rate changes, largely because of our relatively high household debt. This sensitivity means that the BoC might opt for deeper rate cuts to stimulate economic growth and ease the financial strain many Canadians are feeling.

Financial Planning for Homeowners: Adapting to Rate Cuts

What does this mean for you as a homeowner or potential buyer? Well, if you’re considering buying a home, these anticipated rate cuts could result in lower mortgage rates, making it a more opportune time to enter the market. For homeowners, especially those looking to refinance or renew their mortgage, the timing couldn’t be better to lock in a lower rate, potentially saving you a significant amount of money over time.

However, it’s important to note that while lower interest rates can be beneficial for borrowers, they could also lead to a weaker Canadian dollar. This scenario might increase the cost of imported goods, potentially nudging inflation upwards again. It’s a delicate balance, but one that could have silver linings for our local real estate market.

As your trusted real estate advisor, We’re here to help you navigate these changes. Whether you’re planning to buy your dream home or considering selling your property, understanding the broader economic landscape can help us make informed decisions together. If you have any questions about how these potential interest rate changes might affect your real estate plans, please don’t hesitate to reach out. Together, we’ll continue to build your future in the GTA, one thoughtful step at a time.

Free Home Evaluation

Equip yourself with the knowledge to navigate the complexities of the 2024 real estate landscape confidently.