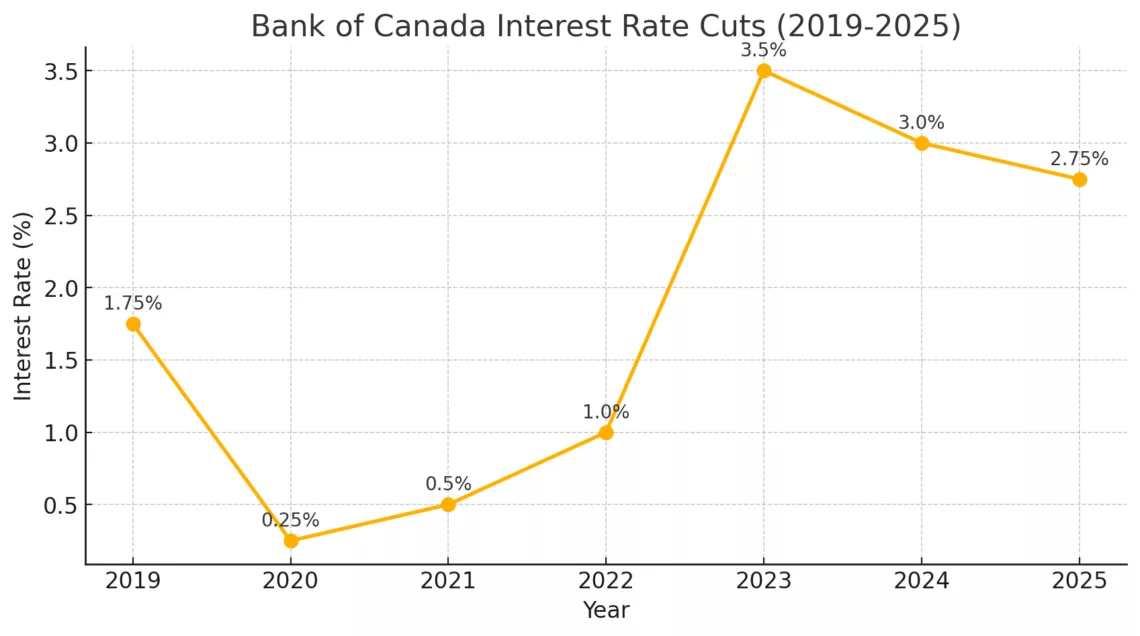

The Bank of Canada officially announced at 9:45 AM ET today, Wednesday (March 12, 2025) a reduction in its target for the overnight rate to 2.75%, with the Bank Rate at 3% and the deposit rate at 2.70%. This move comes amid growing trade tensions with the United States and increasing economic uncertainty. For homebuyers, sellers, and real estate investors in the Greater Toronto Area (GTA), this decision could have significant implications—affecting mortgage rates, home affordability, and overall market activity.

Why Did the Bank of Canada Cut Rates?

The Canadian economy entered 2025 in a strong position, with inflation close to the 2% target and GDP growth showing resilience. However, new tariffs imposed by the U.S. are expected to slow economic activity and increase inflationary pressures. The rapidly evolving policy landscape has created heightened uncertainty, prompting the central bank to act.

At its last announcement on January 29, 2025, the Bank of Canada made a minor reduction to the overnight key lending rate, bringing it down to 3%. The latest cut aims to support economic stability as trade conflicts escalate.

Tiff Macklem, Governor of the Bank of Canada, spoke at the Mississauga Board of Trade on February 21, warning about the unpredictable effects of U.S. tariff policies:

“President (Donald) Trump wants to use tariffs as an instrument of U.S. policy. What that means for the global economy, and for the Canada-U.S. trade relationship, is highly uncertain. Even when we know more, it will be hard to predict the economic impacts because we haven’t experienced such broad-based tariffs since the 1930s.”

How the Interest Rate Announcement Affects the GTA Housing Market

The 0.25% rate cut, bringing the benchmark interest rate down to 2.75%, could have a ripple effect on the housing market:

- Lower Mortgage Rates: If lenders follow the Bank of Canada’s lead, mortgage rates could drop, making homeownership more affordable.

- Increased Buyer Activity: Historically, lower interest rates encourage more buyers to enter the market, increasing demand.

- Impact on Home Prices: More buyers often lead to higher home prices, especially in competitive GTA areas like Toronto, Vaughan, and Richmond Hill.

- Investor Opportunities: Real estate investors may benefit from lower borrowing costs, but trade-related economic volatility could impact long-term rental demand and property values.

What Economists Are Saying

TD Economist Derek Burleton predicted the 25-basis-point cut, bringing the rate to 2.75%.

“Since the inflation data came out a few weeks ago, market odds of a cut fell as low as 30%, but have since jumped to 90% following the imposition of U.S. tariffs on Canadian exports,” Burleton said in a press release.

BMO Chief Economist Douglas Porter expects further cuts ahead:

“We now look for the quarter-point pace to continue in each of the next four meetings until July, taking the rate to 2%. The net risk is that we eventually go even lower if the bank is comfortable with the prevailing inflation backdrop later this year.”

Mark Carney Becomes Prime Minister: What This Means for Canada’s Economy

In a major political shift, Mark Carney has been elected as Canada’s new Prime Minister. Known for his steady leadership as the former Governor of the Bank of Canada (2008-2013) and Bank of England (2013-2020), Carney’s expertise in monetary policy and financial stability could have positive long-term effects on the Canadian economy.

Why this is good news:

- Economic Stability: Carney’s deep understanding of monetary policy means his government is likely to focus on sound economic management, reducing uncertainty for businesses and investors.

- Global Credibility: As a respected figure in global finance, Carney’s leadership could strengthen Canada’s international economic reputation, attracting foreign investment.

- Balanced Growth Approach: His track record suggests a focus on responsible fiscal policies, ensuring growth while keeping inflation in check.

- Housing Market Focus: Given the current interest rate cuts, his leadership may support housing affordability initiatives and market stability, benefiting GTA homebuyers and investors.

With Carney leading Canada, we may see policies that reduce volatility in the housing market, promote sustainable economic growth, and ensure strong financial oversight—all crucial factors for real estate investors and homebuyers navigating the current landscape.

What Could Go Wrong With Bank of Canada Interest Rate Cuts?

While a rate cut provides short-term relief, it carries risks:

- The Canadian dollar remains vulnerable due to trade concerns. A sharp drop in interest rates could further weaken the loonie, increasing the cost of imports, including food and construction materials.

- Inflation may rise as tariffs push up prices, potentially forcing the Bank of Canada to reverse course later in the year.

- Uncertainty in key industries could lead to job losses, slowing market activity despite lower rates.

The Bank’s Stance on Inflation

The Bank of Canada remains committed to maintaining price stability, even amid trade disruptions. While inflation is currently near the 2% target, expectations are rising due to tariff concerns. The central bank is closely monitoring consumer confidence, business spending, and job market trends.

What Should You Do?

For homebuyers: Lower rates could improve affordability—but be prepared for competition. Lock in a mortgage rate early to protect against market shifts.

For sellers: Buyer demand is likely to increase, making this a great time to list your home. Pricing strategically will help you stand out in a competitive market.

For investors: Lower borrowing costs create opportunities, but trade uncertainties mean risk management is crucial. Diversify your investment strategy to navigate potential market fluctuations.

Stay Ahead of Market Changes

With the Bank of Canada Interest Rate Announcement shaping the housing market, staying informed is key. Follow our blog for expert insights on policy shifts and their impact on GTA real estate. Have questions about buying, selling, or investing? Contact us today for personalized guidance on your next real estate move.

Next Rate Announcement: April 16, 2025

The Bank will release its next full economic outlook, including inflation risks, in its April Monetary Policy Report (MPR).

Contact Us

Equip yourself with the knowledge to navigate the complexities of the real estate landscape confidently.