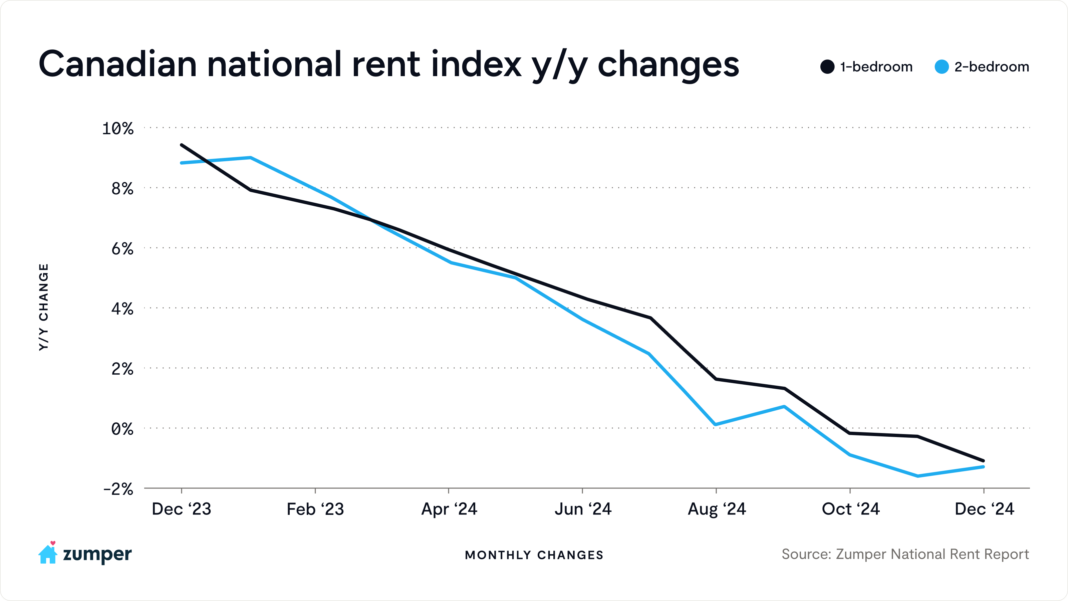

If you’ve been following the rental market in Canada, here’s a headline you probably didn’t expect: rent prices are starting to drop. Yes, after years of sharp increases and an affordability crisis that seemed unstoppable, renters are finally seeing some relief. But why now? Let’s dive into what’s driving this shift and what it could mean for renters, landlords, and investors in cities like Toronto and Vancouver.

The Curious Case of Falling Rents

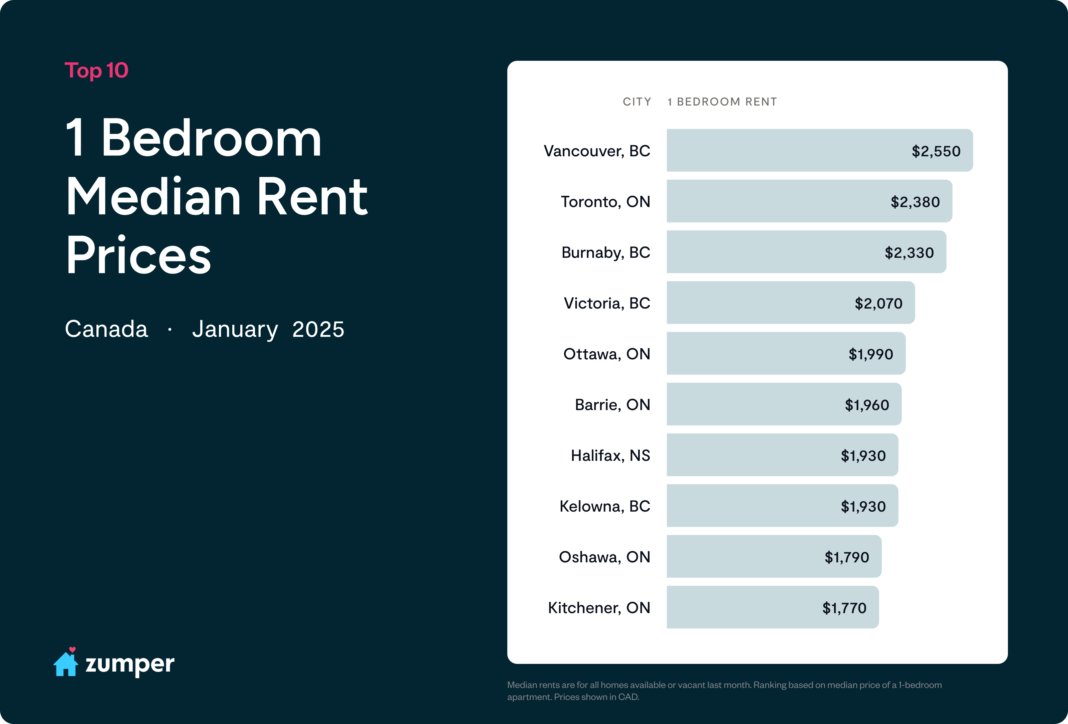

Take this example: a one-bedroom, one-bathroom apartment in downtown Toronto that rented for $2,380 in 2022 was recently listed for $2,288. It’s not a massive drop, but it’s a sign of change. Similar trends are being seen in Vancouver, where rents for a one-bedroom apartment have dipped by about $100 compared to last year. After years of relentless increases, why are rents finally falling?

Supply Meets the Market

In 2024, something surprising happened: the supply of rental units in Canada’s major cities increased significantly. Over 5,000 new rental apartment units were completed in Toronto last year alone, a level not seen in years. High-rise buildings with hundreds of units, including condos and purpose-built rentals, are hitting the market all at once. This sudden influx is creating competition among landlords eager to fill their buildings, putting downward pressure on rents.

But where did this surge in supply come from? It’s the result of projects started years ago when interest rates and construction costs were much lower. For example, many of the high-rises you see now were planned and approved around 2016. Fast forward to today, and these projects are finally being completed.

Condos Flood the Market

Toronto also saw a record number of condos completed last year—30,000 units, compared to the 10-year average of 20,000. Many of these condos were originally purchased as investment properties, with buyers hoping to sell them at a profit. However, with rising interest rates, higher development fees, and cooling demand, those profits have evaporated for many investors. Unable to sell, many owners are opting to rent their units, further increasing the supply of rental properties.

A Shift in Demand

While supply is rising, demand is starting to soften. Canada’s population grew by about three million people over the past three years, but that growth is slowing. Recently, the government announced cuts to immigration levels and placed caps on international student permits. These policy changes are already having an impact. For example, the number of international students enrolled in Canadian colleges and universities dropped by 45% in 2024 compared to the previous year. Cities with large student populations, like London and Kitchener, are seeing rents fall even faster.

Another factor is the rising cost of living. With inflation, high unemployment rates (8.4% in Toronto as of December 2024), and a weakened job market, many young Canadians are choosing to stay with family or share housing. Listings for shared accommodations in provinces like Ontario and British Columbia have surged nearly 50% in the past year. While rent prices are coming down, they’re still far from affordable for many, forcing people to find creative solutions.

What This Means for Renters

If you’re a renter, this year might be your best chance to find a deal. While prices remain high, the trends suggest they’ll continue to soften as more units come onto the market and demand adjusts. Keep an eye on new rental listings, particularly in high-supply areas like downtown Toronto and Vancouver. You might find landlords more willing to negotiate terms or offer incentives to fill vacancies.

A Word for Investors and Landlords

For landlords and investors, this market shift means adapting to a new reality. Competition is heating up, and the days of easily commanding top-dollar rents may be over, at least for now. If you’re renting out a property, focus on making it stand out by offering upgrades, flexible terms, or other perks. For those considering buying investment properties, the cooling market could present opportunities, but be prepared for tighter profit margins.

The Road Ahead

As more rental units come online and population growth slows, we’re likely to see continued pressure on rent prices. However, the long-term outlook remains uncertain. Will supply keep pace with demand in the coming years? How will economic conditions evolve? These are questions that will shape the future of Canada’s rental market.

For now, renters, landlords, and investors alike should stay informed and ready to adapt. Whether you’re searching for a new home or planning your next investment, understanding these trends will give you an edge.

Looking for your next rental or investment opportunity? The Daryl King Team has you covered. Contact us today for personalized advice and exclusive listings. Let us help you navigate the ever-changing real estate market with confidence!

Contact Us

Equip yourself with the knowledge to navigate the complexities of the real estate landscape confidently.