The Greater Toronto Area’s real estate market is making headlines with a surge in activity following the Bank of Canada’s interest rate cuts. November 2024 brought a remarkable 40.1% increase in home sales compared to the same month last year, setting the stage for what experts believe could be a thriving recovery in 2025. But what does this mean for buyers, sellers, and investors? Let’s break it down.

Key Highlights from the November Report

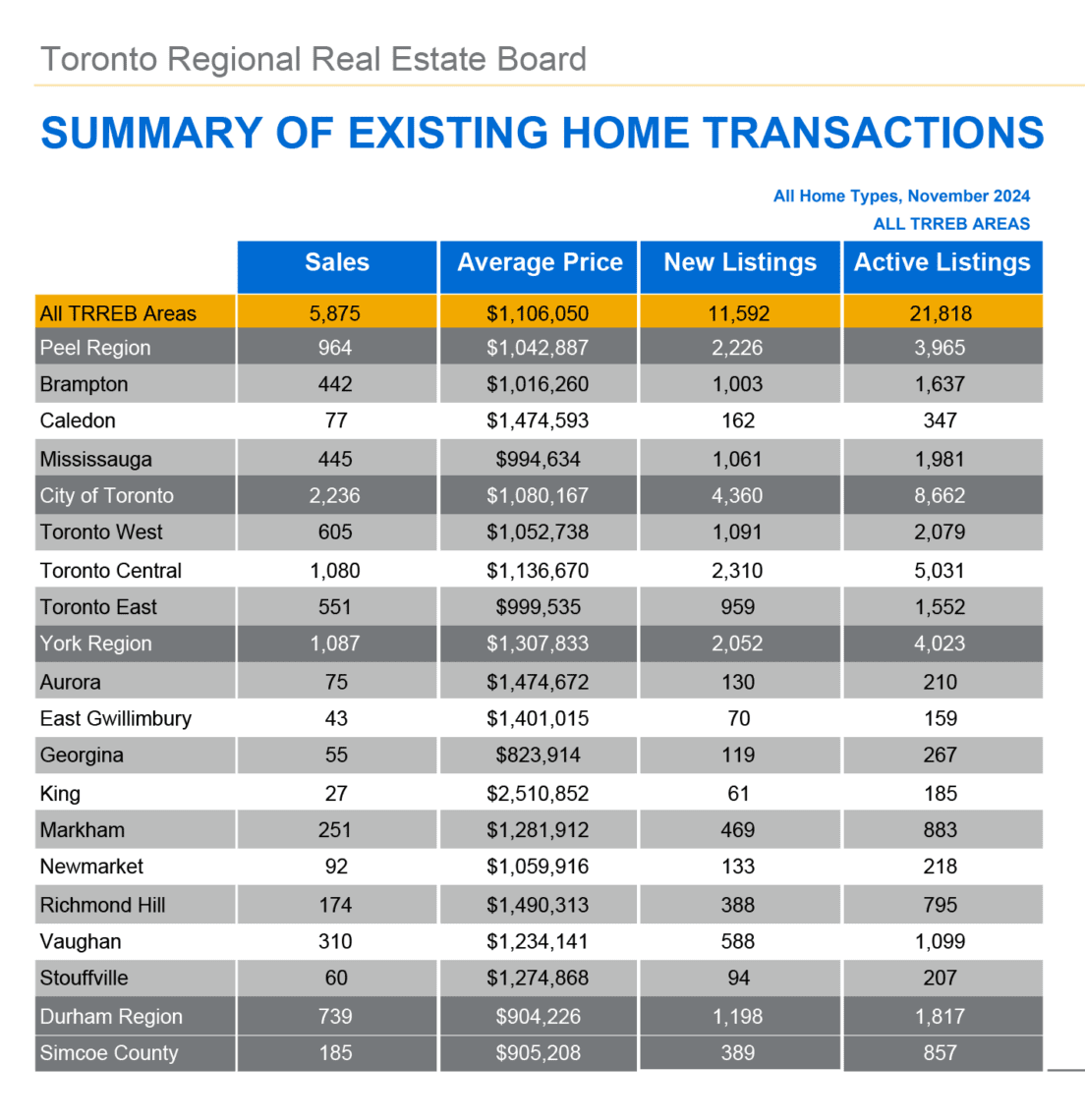

- Sales Surge: 5,875 homes sold in November 2024, a 40.1% year-over-year increase.

- Rising Listings: New listings climbed 6.6% to 11,592 but lagged behind demand, tightening market conditions.

- Price Trends:

- Detached Homes: Prices rose above the inflation rate, particularly in Toronto, with a strong 43.9% sales increase year-over-year.

- Condos: Prices dipped 5.04% to $649,200, giving buyers more negotiating power.

- Average Selling Price: Up 2.6% to $1,106,050 compared to last year.

What’s Driving the Market?

Lower interest rates have been a game-changer. Buyers who had been waiting on the sidelines are now re-entering the market. With borrowing costs trending lower and selling prices well below their peak, affordability is improving, and confidence is returning.

Jason Mercer, TRREB’s Chief Market Analyst, highlighted the appeal for condo buyers: “With a lot of choice and negotiating power, condos are an attractive option for renters transitioning to homeownership.”

What This Means for You

Whether you’re a first-time buyer, an investor, or planning to sell, these trends have implications:

- For Buyers:

- Detached homes are rebounding quickly—act soon to secure competitive pricing.

- Condos offer affordability and leverage for negotiations, making them a prime option for entry into homeownership.

- For Sellers:

- Tightened market conditions are in your favor. Increased demand may lead to quicker sales and better prices, especially for single-family homes.

- For Investors:

- With a strong rental market and rising homeownership demand, now may be the time to expand your portfolio.

The Path Forward

TRREB predicts 2025 will see an accelerating market recovery. As the Bank of Canada continues to adjust rates—potentially lowering them further this month—expect continued momentum in Toronto’s housing sector.

Why This Matters Now

Toronto’s housing market is not just recovering; it’s evolving. The current conditions present unique opportunities for all stakeholders, but acting strategically is key.

Stay Ahead of the Market

Want to stay informed about the latest trends and opportunities in Toronto’s real estate market? Follow our blog for up-to-date news and insights. Ready to make your next move? Contact us today—let’s navigate the market together!

Summary of November 2024 Trends

- Sales up 40.1% year-over-year.

- Detached homes lead the rebound.

- Condo buyers enjoy negotiating power.

- Market conditions favor sellers.

- Continued interest rate cuts expected to fuel growth.

The Toronto real estate market is buzzing—don’t miss your chance to capitalize on the momentum!

Contact Us

Equip yourself with the knowledge to navigate the complexities of the real estate landscape confidently.