Condominiums have become a prime entryway into the real estate market, particularly attractive for their affordability compared to townhouses and single-family homes. Whether as a primary residence or an investment property, understanding the potential for equity growth is crucial for anyone entering the market. Carrie Lysenko, CEO of Zoocasa, emphasizes, “In the past five years in the GTA, condos have proven to be an effective stepping stone for rapidly building equity.”

Impact of Location on Condo Investments in Toronto and the GTA

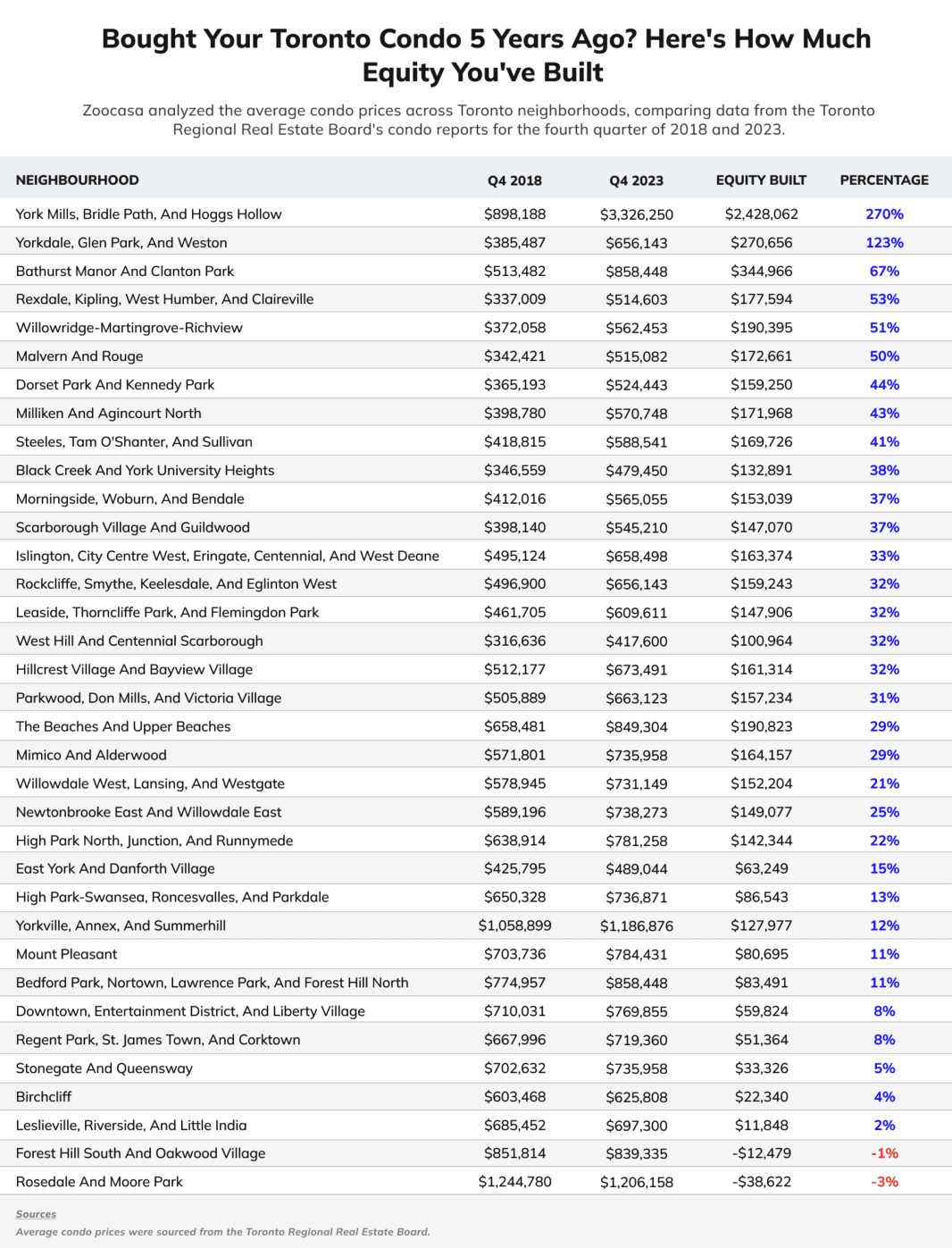

In Toronto and the surrounding Greater Toronto Area (GTA), the location of your condo purchase significantly impacts your return on investment. According to a recent analysis by Zoocasa, which examined condo prices from the Toronto Regional Real Estate Board, the equity growth in various neighborhoods and cities over the last five years is staggering.

Top Performers in Condo Price Increases

The most significant increases were seen in neighborhoods like York Mills, Bridle Path, and Hoggs Hollow, where condo prices jumped from an average of $898,188 in July 2018 to a whopping $3.3M in 2023—a 270% increase. Other notable areas include Yorkdale, Glen Park, and Weston, with a 123% rise, and Bathurst Manor and Clanton Park, where prices grew by 67%.

The Few Exceptions

Not all areas saw increases; Forest Hill South and Oakwood Village experienced a slight decrease of about 1%, and Rosedale Moore Park saw a 3% dip. These areas are among the pricier markets for condos in Toronto, possibly limiting buyer interest due to higher initial prices.

However, across all 35 analyzed neighborhoods, there was an impressive overall average increase of 36% in condo values.

The GTA’s Booming Condo Market

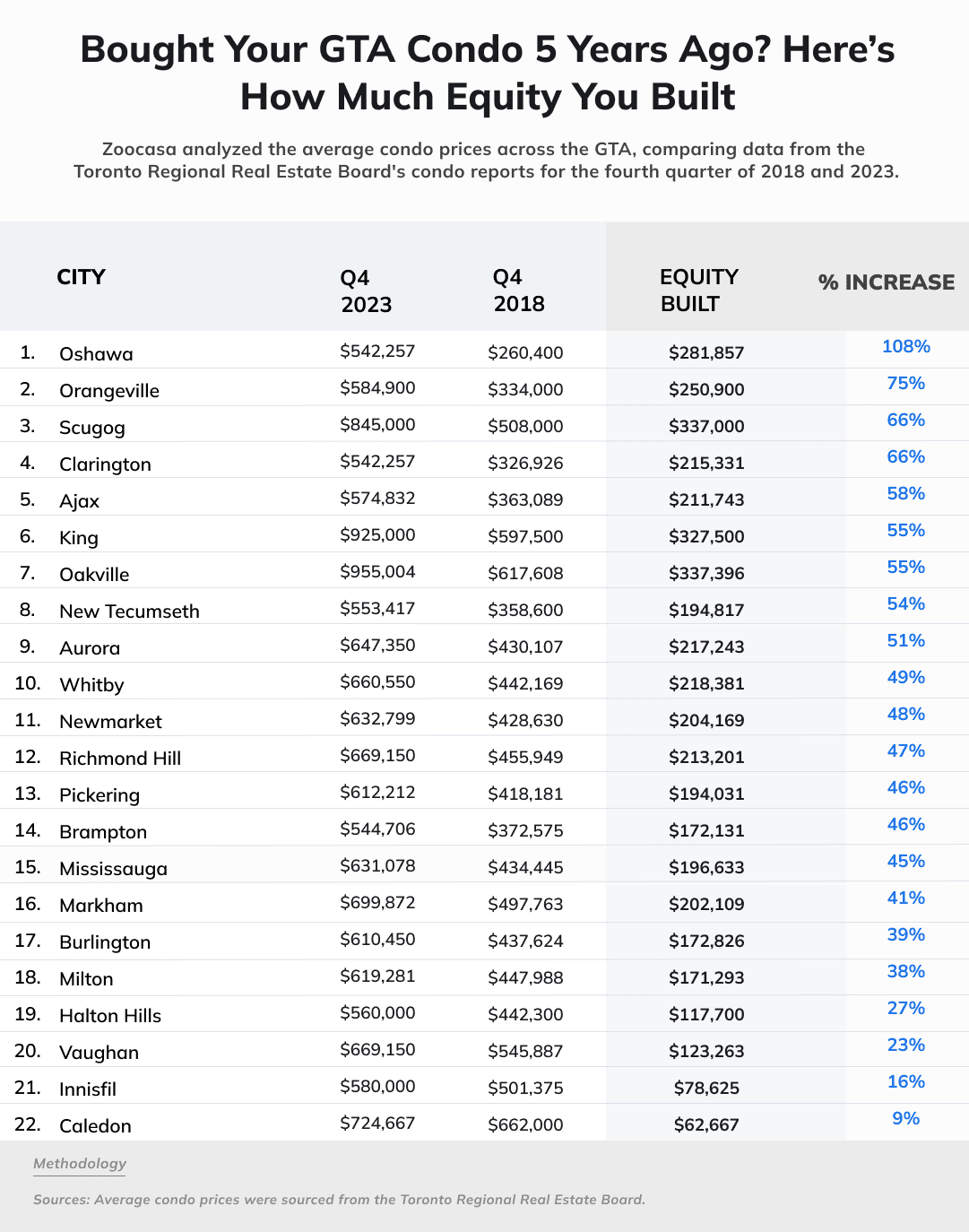

When looking beyond Toronto to the GTA, the growth is equally remarkable. Over the past five years, the average condo price across 22 cities has surged by an average of 48%. Cities like Oshawa, Orangeville, and Scugog have seen the highest increases, with Oshawa condos appreciating by 108% since 2018.

Cities with the Highest Equity Gains:

- Oshawa: From $260,400 in 2018 to $542,257 in 2023.

- Orangeville: From $334,000 to $584,900.

- Scugog: From $508,000 to $845,000.

Areas with Slower Growth

Conversely, cities like Vaughan, Innisfil, and Caledon saw more modest growth rates of 23%, 16%, and 9%, respectively. Despite these lower figures, they still represent positive equity growth over a relatively short period.

Why Invest in Toronto Condos?

The past five years have seen a pandemic-driven surge in property values, significantly benefiting those who invested in the GTA and Toronto condo markets. As a result, condo owners have enjoyed substantial equity increases, highlighting the resilience and potential of the real estate market in this region.

Considering buying a condo in Toronto or the GTA? Contact us today! Our experienced real estate agents are ready to help you navigate the condo market and find a property that suits your investment needs and lifestyle preferences.

Free Home Evaluation

Equip yourself with the knowledge to navigate the complexities of the 2024 real estate landscape confidently.