A Financial Crossroads for Canadians

The start of 2024 has seen Canadians at a pivotal financial crossroads, debating whether to rent or buy amidst a shifting real estate landscape. With the overnight lending rate holding steady and fixed mortgage rates beginning to decrease, the decision between renting and buying has become more complex than ever.

A Comprehensive Analysis

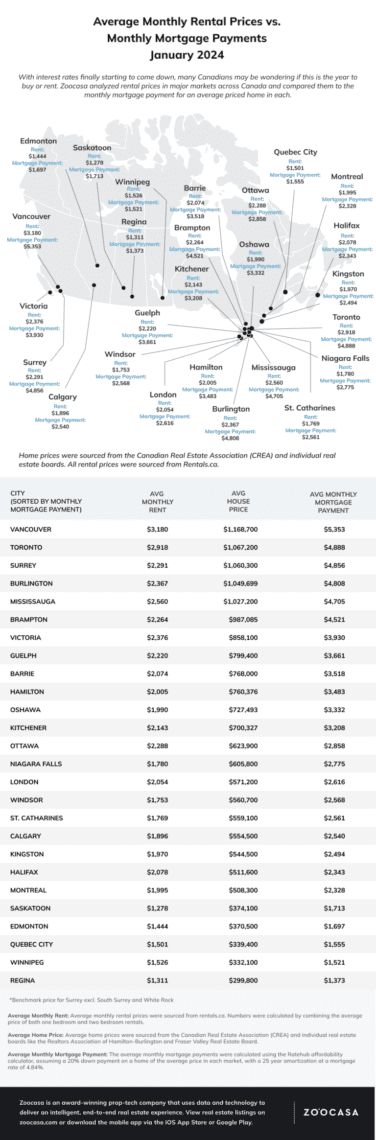

Our analysis delves into the rent vs. buy question across 26 Canadian markets, with a particular focus on Ontario and the Greater Toronto Area (GTA). This exploration is critical for those navigating the fluctuating dynamics of today’s real estate market.

The Findings Unveiled

Renting vs. Buying – The Cost Comparison in 2024

As fixed mortgage rates dipped to 4.89% in January from a peak of 5.49%, the landscape for potential homeowners and renters has evolved. Our study, leveraging data from Zoocasa and Rentals.ca, examines the monthly costs of renting versus buying, offering a clear picture without the cloud of additional homeownership expenses like utilities and property taxes.

Ontario and the GTA: A Closer Look

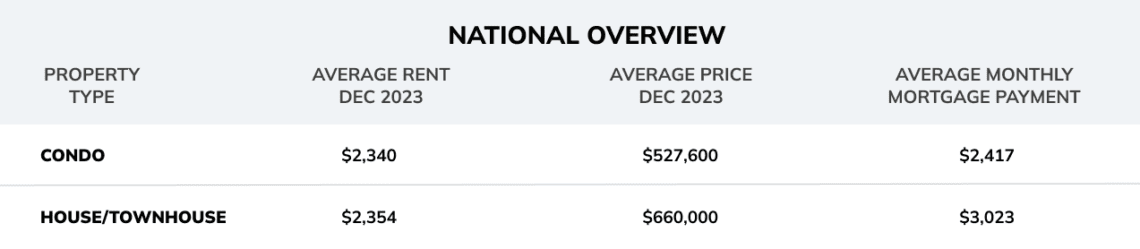

The disparity between renting and buying in Ontario, especially in the GTA, presents a unique case. For condos, the national average rent stands at $2,340, closely matched by a monthly mortgage payment of $2,417, showcasing the narrowing gap in affordability. However, the situation in the GTA is more pronounced, with cities like Surrey and Brampton experiencing significant differences between rent and mortgage costs, exceeding $2,000.

Toronto, while slightly less extreme, still shows a notable gap of $1,970 between renting and buying, highlighting the challenges within the GTA market. Contrastingly, in markets like Winnipeg, Regina, and Quebec City, buying has become comparably affordable, with monthly mortgage payments closely aligning with, or even falling below, average rents.

Source: zoocasa.wpengine.com/rent-vs-mortgage-costs-jan-2024

Navigating Market Dynamics

Kingston emerges as the most affordable Ontario market for buying, presenting an opportunity for those considering homeownership over renting. Meanwhile, cities like St. Catharines and Windsor offer competitive advantages for renters. This variability underscores the importance of localized market analysis for making informed decisions.

Making an Informed Choice in 2024

The decision to rent or buy in Canada, particularly in Ontario and the GTA, requires careful consideration of current market trends, including the impact of interest rates on both housing and rental markets. Our comprehensive review serves as a foundational resource for Canadians at this financial juncture, emphasizing the need for thorough planning and market understanding.

Free Buyer Consultation

Equip yourself with the knowledge to navigate the complexities of the 2024 real estate landscape confidently.